Zero Credit versus. Less than perfect credit: What things to See

Conclusion At the start

- Which have no credit simply form the major credit reporting agencies and you can lenders don’t possess sufficient information about how creditworthy youre. But you can take the appropriate steps to ascertain brand new borrowing from the bank and begin building a credit rating.

- If you have poor credit, you’ve almost certainly produced specific missteps when you’ve lent cash in the newest earlier. Don’t worry! There are methods you might alter your credit history.

- You really need to go with a good credit score to be eligible for the best terms and conditions and you will rates of interest to your finance and you may playing cards.

Time for you See

I hear much concerning the significance of that have a good credit score. You could be aware that which have a good credit score normally qualify your for most useful terminology and you will interest levels to have playing cards and you may fund. Enterprises such as for instance phone providers and you can resources in addition to apartment leasing professionals in addition to look at the credit. But what happens when you yourself have no borrowing from the bank no credit records, or your own credit isn’t really solid? Isn’t any credit better than poor credit? Given that affairs are very different, for each and every poses similar pressures.

Starting Borrowing from the bank

Having zero credit is not http://cashadvancecompass.com/installment-loans-mo/augusta the just like having less than perfect credit. When you have no borrowing, this means one credit bureaus don’t have any financial information about your as you don’t have a credit report. This might be just like the you’ve never removed a car loan, a personal bank loan otherwise a credit card. You’ve got no credit history so they really can not do a credit check. When loan providers do not know whenever you are a cards chance, it can be hard for you to receive that loan otherwise credit card. And you will, its also difficult for the right playing cards readily available.

- Query a close relative to add you just like the a third party affiliate on the credit card. You are getting their mastercard, although top cards owner kits a spending limitation precisely how far you might charges. This arrangement also offers advantages of the two of you. Become familiar with the way you use borrowing wisely, additionally the membership manager normally earn rewards on the instructions.

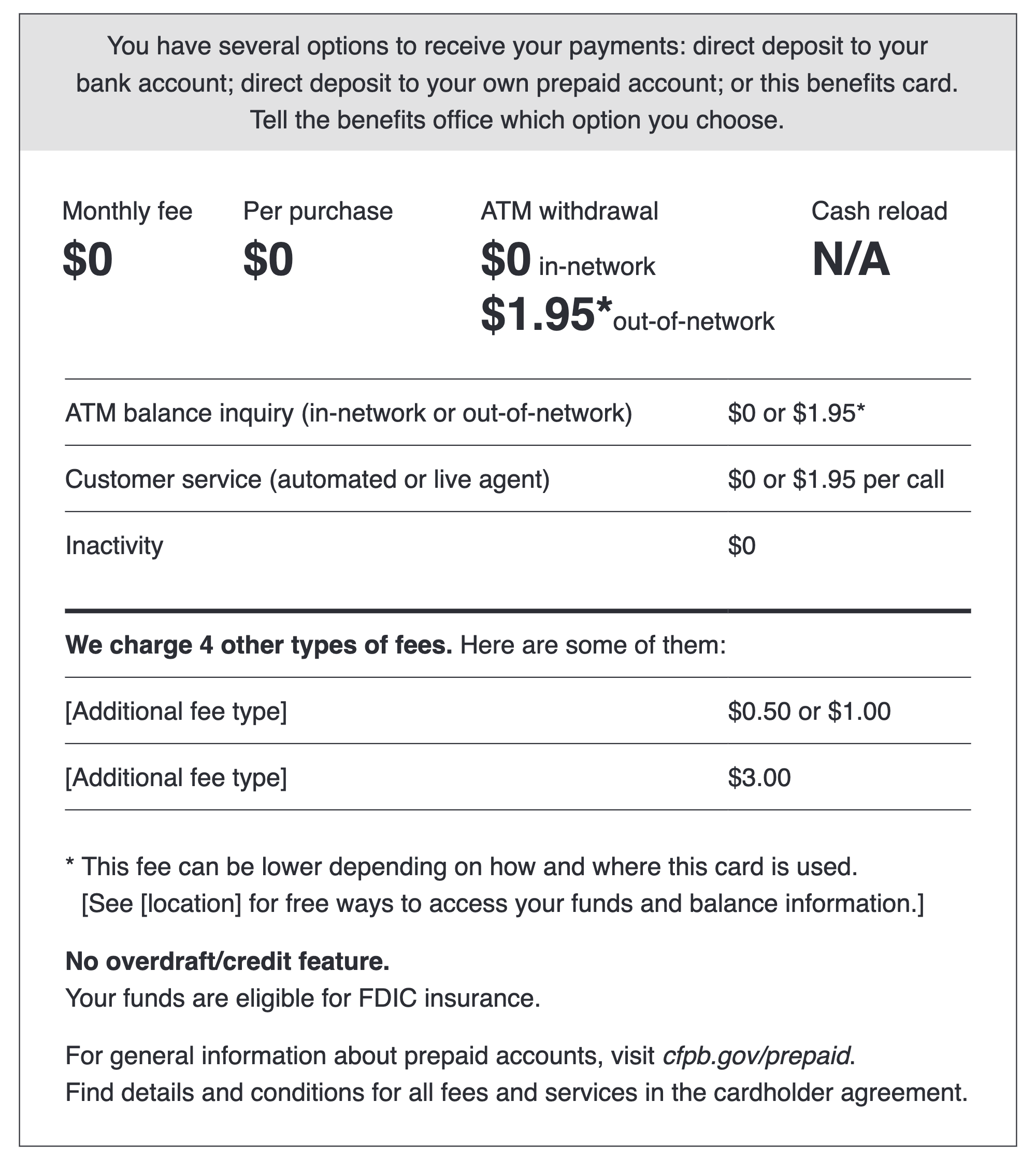

- Get a secured mastercard. It is possible to build a cash put to your a savings account. This deposit acts as security to own charges you make to your card. Such, for people who put $3 hundred on the a family savings when you get a protected bank card, that matter will be your credit limit. Build into-time payments and continue maintaining a low harmony to help build your borrowing. Given that an added bonus, you’re qualified to receive charge card benefits. And you may, having a cards eg Navy Federal Borrowing Union’s nRewards Protected credit, you can earn dividends towards the very first deposit you add into the the latest savings account. It can take regarding six so you’re able to 9 weeks to establish borrowing out of abrasion. Let you know lenders their creditworthiness and sustain the latest energy going by learning more about bringing the best strategies when you have zero borrowing from the bank.

Flipping Doing Bad credit

Which have a low credit rating says to lenders or other firms that you have got particular difficulties dealing with yours earnings. Perhaps you have got the display lately repayments or gone over your own mastercard limitation. But don’t give up! You’re able to find your bad credit score swinging on the proper guidance towards the pursuing the steps:

- Shell out your credit card bills timely to develop good fee record. Restrict your monthly spending and attempt to shell out over the fresh lowest monthly payments due on your own credit card debt, when possible. This shows lenders that you will be in charge and you can managing your money responsibly.

- Avoid using all of your readily available borrowing on your own playing cards. Financial specialists recommend preserving your borrowing utilization low and not maxing out your credit cards and other lines of credit.

- Make sure the details about your credit score can be go out. Look at your credit history every year to find problems you to could affect your credit score. If you find a blunder, report it with the compatible borrowing agency.

- Find out what otherwise you can do for those who have worst credit and need assist enhancing your borrowing from the bank.

On track

Whether you’re working to help make your borrowing from the bank otherwise come into the procedure of repairing they, Navy Federal Credit Connection has arrived to you. Discover more about all of our products and services that can assist, particularly all of our shielded charge card. Navy Government participants normally look at the credit score free-of-charge. If you have zero borrowing otherwise less than perfect credit, we are able to make it easier to works towards the good credit.

Bir Yorum Yazın